Bad Debts Recovered Journal Entry

Your books must reflect the recovered amount. This write-off is often called bad.

Journal Entry For Bad Debts And Bad Debts Recovered Geeksforgeeks

This can either be the complete amount.

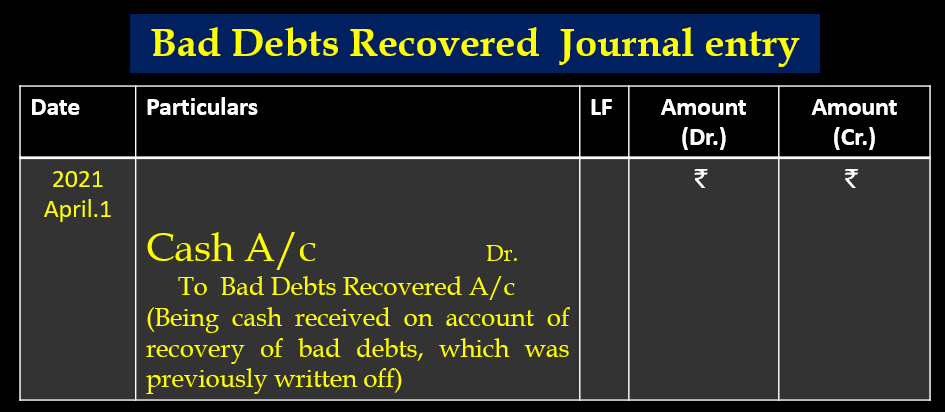

. I Cash Ac Dr. For example company XYZ Ltd. When in one accounting year we declared that the money from the debtor is bad debts but in the next accounting year the money is recovered that.

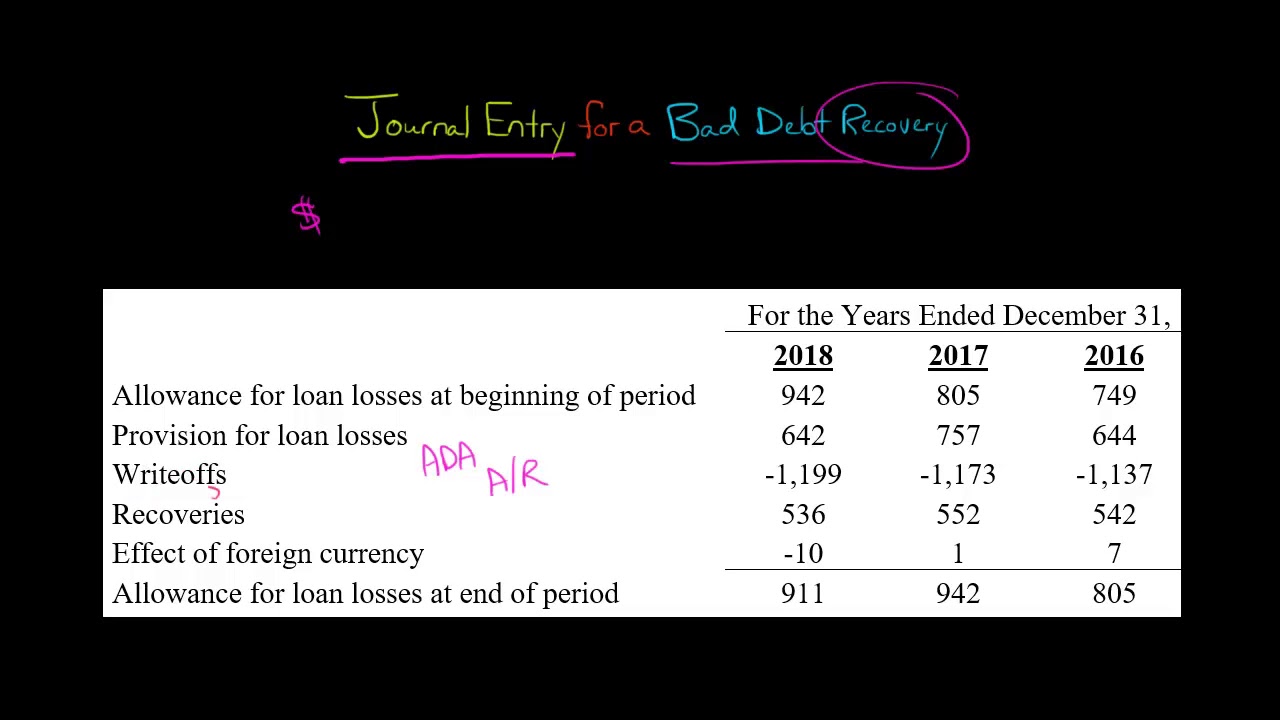

Journal entry for the bad debt recovered with the golden rule. A business had previously written off a bad debt of 2000 using the allowance method for bad debts but has now managed to make a bad debt recovery and has received 900 in part. 01012018 received Rs 5000- written as bad in 201617.

Few reasons for debtors to not pay their debts on time may be. All the nominal accounts hit the statement of profit or loss. Decides to write off one of its customers Mr.

In this accounting lesson we explain what bad debt and bad debt recovered are. I would do the following journal entries to account for the recovered bad debts and also the expense of the debt collection agency. Now as provision for bad debts 2 on debtors is to made.

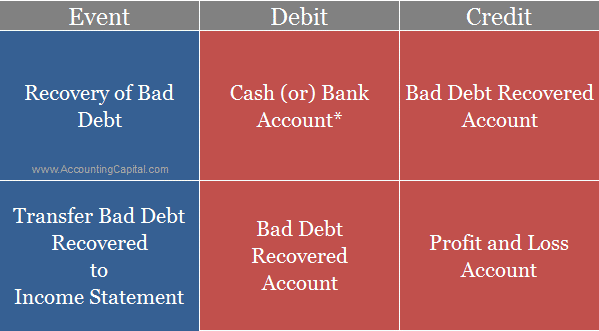

1 Bad debts Journal Entry. Bad Debts are loss to the business and falls under Nominal accounts. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account.

Dr Bank13000 Cr Bad Debts Recovered13000 Dr. Here provision for bad debts for last year is given in trial balance is given. Using the percentage of sales method they estimated that 1 of.

Definition Journal Entry Accounting Tax Treatment. Partially or fully irrecoverable debts are called bad debts. How you create a bad debt recovery journal.

Explanation of the applicability of the. Heres an example. Later when it receives the 10000 payment from the customer as a form of bad debt recovered it can make the journal entry for the bad debt recovered as below.

Bad Debt Recovery. Bad debts recover and its journal entry. When the goods are sold to a customer on credit and if the amount becomes irrecoverable due to his insolvency or for some other reason the amount not.

To Profit and Loss Ac. On March 31 2017 Corporate Finance Institute reported net credit sales of 1000000. We show how to record a bad debt recovered journal entry and how to account f.

To Bad Debts Recovered Ac ii Bad Debts Recovered Ac Dr. Z as uncollectible with a balance of USD 350. This recovered amount may be a partial payment received against the total of the written-off amount or it may be a lower amount agreed with the company for the total written-off amount.

It means we have to make new provision. As seen in the above journal entries the direct write-off method can potentially misstate the bad debts expense between the periods because a write-off from previous period. Bad debt recovery means you need to create new journal entries in your books.

Filing for bankruptcy experiencing hardship due to losses etc. INTRODUCTION -Bad DebtsWhen the goods are sold to customers on credit there can be a situation where a few of them fail to pay the amount due to them beca. Companies write off debts that they deem as uncollectible.

Answer 1 of 13.

Journal Entries For Bad Debts And Bad Debts Recovered Youtube

Journal Entry For A Bad Debt Recovery Youtube

No comments for "Bad Debts Recovered Journal Entry"

Post a Comment